Global payroll services, simplified

Your payroll in Mexico,

simplified

Your payroll in The Philippines, simplified

Run fast and compliant payroll for your team in 30+ countries using a single platform.

Run fast and compliant payroll for your Mexico team, plus 30+ other countries using a single platform.

Run fast and compliant payroll for your Filipino team, and 30+ other countries using a single platform.

_Leader_Leader%201%20(2)%20(3).svg)

Trusted by teams and partners

Oyster makes global payroll

effortless

effortless

Save time by using a single platform

Use a single platform to run payroll for your global employees, EOR Team Members, and contractors, and standardize your employee experience.

Eliminate manual payroll tasks

Instantly calculate payroll costs, track your payroll cycle, manage expenses and time off, and generate reports and payslips using simple, automated workflows.

Stay on top of payroll compliance

Receive expert support and local knowledge from our payroll consultants as they guide you through every step of the payroll process.

Keep a clear view of payroll data

Effortlessly sync your payroll data and workflows with your HRIS, ERP, and expense management software to avoid errors and repetitive data entry.

Save time by using a single platform

Use a single platform to run payroll for your Mexico employees, EOR Team Members, and contractors, and standardize your employee experience.

Eliminate manual payroll tasks

Instantly calculate payroll costs, track your payroll cycle, manage expenses and time off, and generate reports and payslips using simple, automated workflows.

Stay on top of payroll compliance

Receive expert support and local Mexico knowledge from our payroll consultants as they guide you through every step of the payroll process.

Keep a clear view of payroll data

Effortlessly sync your payroll data and workflows with your HRIS, ERP, and expense management software to avoid errors and repetitive data entry.

Save time by using a single platform

Use a single platform to run payroll for your Filipino employees, EOR Team Members, and contractors, and standardize your employee experience.

Eliminate manual payroll tasks

Instantly calculate payroll costs, track your payroll cycle, manage expenses and time off, and generate reports and payslips using simple, automated workflows.

Stay on top of payroll compliance

Receive expert support and local knowledge on The Philippines from our payroll consultants as they guide you through every step of the payroll process.

Keep a clear view of payroll data

Effortlessly sync your payroll data and workflows with your HRIS, ERP, and expense management software to avoid errors and repetitive data entry.

An international payroll provider to help you expand your team

An international payroll provider to help you expand your team, in Mexico and beyond

An international payroll provider to help you expand your team, in The Philippines and beyond

See how our platform and experts handle your payroll so you can focus on growing your stellar, global team.

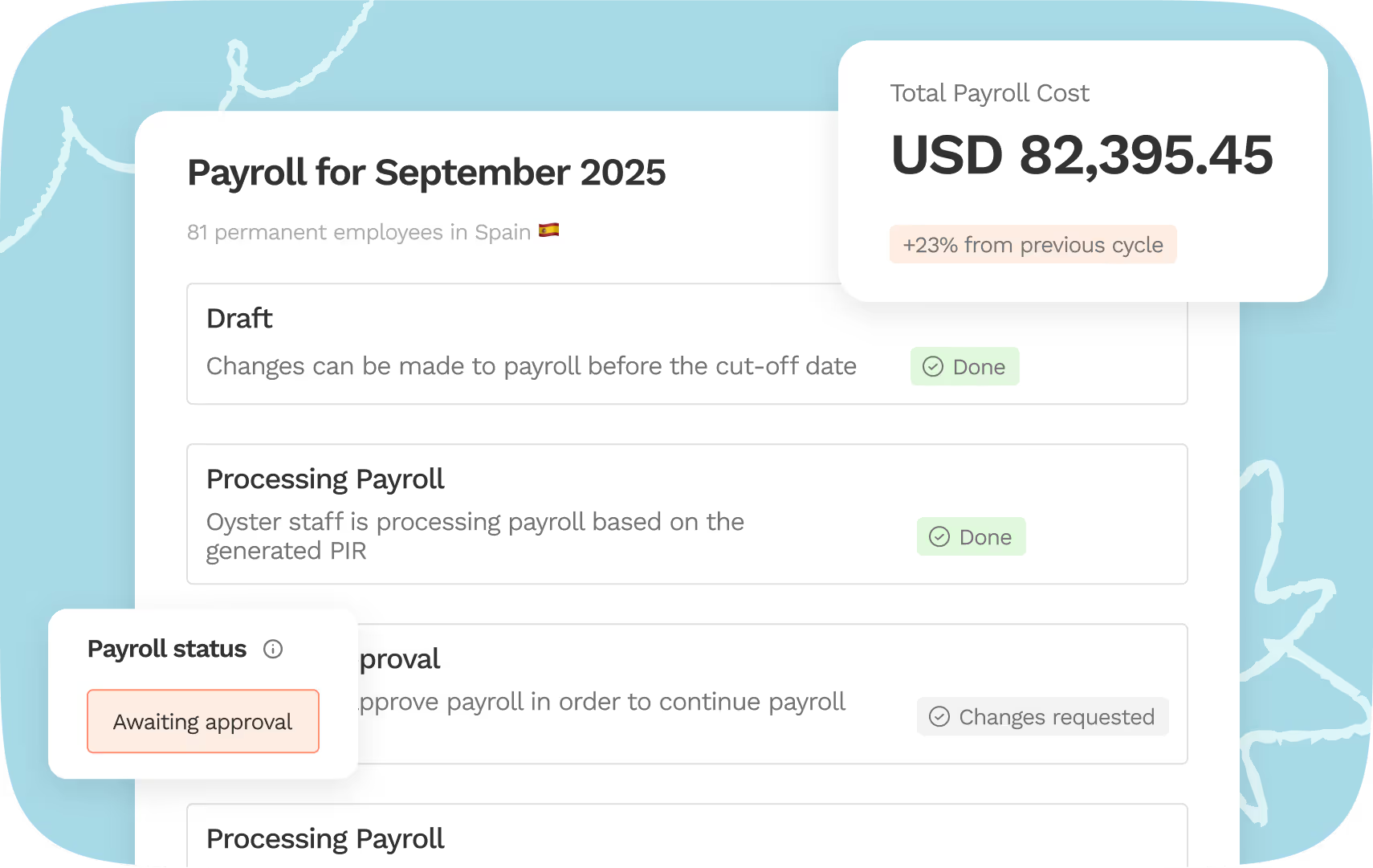

Payroll cycle management

Instantly review and approve payroll cycle and variance data, and request payroll adjustments if needed. Our local payroll experts will validate your payroll data and ensure compliance.

Automated payroll reports

View globally standardized gross-to-net and variance reports and entity-specific payment instructions to reconcile your costs and facilitate payments to employees and local authorities.

User-friendly interface

Give your multi-country team members access to a simple interface to submit and track expenses, request and track time off, and view their payslips and payroll data.

Robust integrations

Simplify your payroll operations by connecting Oyster with your HRIS, ERP, equity, and expense management software. Sync payroll data and workflows to ensure accuracy and avoid manual data entry.

Where is global payroll available?

Mexico is just the start.

Where is global payroll available?

The Philippines is just the start. Where is global payroll available?

Why choose Oyster for your global payroll needs

Why choose Oyster for your Mexico payroll needs

Why choose Oyster for your Philippines payroll needs

Expert, human support

Beyond our powerful payroll platform, our team of local experts is by your side—so you’re never left dealing with global payroll complexities alone.

Compliance-first

We don’t cut corners. As a certified B Corp, Oyster runs all your payroll operations compliantly and prioritizes your data security.

Transparent pricing

All of our pricing details are shared with you upfront so you can make an informed decision. We don’t believe in surprises or hidden charges.

Prices that fit your global hiring needs

Access extensive country coverage, exceptional expert support, and features to offer delightful employee experiences anywhere.

_Leader_Leader%201%20(2)%20(3).svg)

_Leader_UnitedKingdom_Leader%201%20(1).svg)

_Leader_Europe_Leader%201%20(1).svg)

_Leader_Mid-Market_Leader%201%20(1).svg)

_Leader_Small-Business_Europe_Leader%202%20(2).svg)

_Leader_Small-Business_Europe_Leader%202%20(2).svg)

_Leader_Small-Business_Leader%201%20(1).svg)

_FastestImplementation_Small-Business_GoLiveTime%201%20(1)%20(1).svg)

Contractor

Hire, pay, and manage contractors

Employer of Record

Hire, pay, and manage full-timers without entity setup

Payroll

Manage payroll for your global entities

Discover global payroll for cross-border team expansion

Discover global payroll for Mexico team expansion

Discover global payroll for Filipino team expansion

Unlock the power of a distributed workforce with easy payroll management, ensuring compliance, transparency, and efficiency—all in one convenient platform. Ready to simplify your global payroll experience?

FAQs

Which payroll services can a global payroll company perform?

With Oyster, you can manage all your global payroll operations in one compliant platform. This includes reviewing and editing payroll runs using a simple workflow,

tracking expenses and time off, generating pay slips and payroll reports, receiving guidance from Oyster's global payroll consultants, and automatically syncing payroll data with your HRIS and expense management software. Oyster can also facilitates payments to your employees in certain locations.

In which countries does Oyster offer global payroll?

From India to Brazil, Singapore to Canada—Oyster acts as a global payroll provider in 26 countries across 5 continents. With more regions coming soon, you can deliver compliant and accurate payments from a single platform that grows alongside you. Check our country availability to see where your organization can expand next.

In which countries does Oyster offer global payroll?

From India to Brazil, Singapore to Canada—Oyster acts as a global payroll provider in 26 countries across 5 continents. With more regions coming soon, you can deliver compliant and accurate payments from a single platform that grows alongside you. Check our country availability to see where your organization can expand next.

How does Oyster ensure compliance with labour and tax laws in other countries?

Oyster’s in-house legal and HRBP team works side-by-side with regional experts, building local payroll knowledge and insights directly into the platform. Our platform then takes care of all payroll requirements, including tax calculations and withholdings, expense reimbursements, and payroll reports. Our payroll specialists ensure each payroll cycle is completed accurately and on-time while adhering to local regulations.

How long does it take to implement international payroll?

Implementation timelines vary based on a few factors such as country, migration from another provider, and the need to do a parallel payroll run. Our onboarding success team will work with you to create a clear roadmap for you and your team.

How does Oyster protect personal data?

When evaluating international payroll providers, data security and privacy are non-negotiables. At Oyster, protecting your personal data is a top priority. We incorporate data security into software development using GDPR and SOC 2-compliant internal practices and localized intellectual property models.

What is the difference between employer of record and global payroll?

An employer of record (EOR) legally employs workers on your behalf and is responsible for all aspects of employment. You can use an EOR to engage talent in countries where you don’t have an entity.

Global payroll helps you manage payroll and pay your own employees in countries where you have a business entity. When using global payroll, you remain responsible for all aspects of employment.

How can I get set up with global payroll?

Once you meet with your account manager and finalize the details, our onboarding team will work with you to create your company entity in the Oyster platform, facilitate the setup process, and offer information sessions for your team. After that, a country-specific payroll specialist will process your payroll data, prepare reports, and handle your payroll updates and queries. Our customer support team will also be available to answer any questions and offer guidance.

Can Oyster pay my employees’ salaries and taxes?

Paying your direct employees' salaries, local taxes and statutory payments depends on country-specific regulations and customer preference. There are countries where Oyster is able to execute part or all of the payments on your behalf. Likewise, there are countries where the customer has to execute the payments directly.

Why companies around the world choose Oyster

Magda Tulacz

Head of Finance at Paired

“

Oyster streamlines payroll and provides accurate and accessible reporting that’s been a huge help for accounting. Reports are easy to generate, which saves us time and reduces manual work.”

Ana Sekulic

HR Generalist at Kinsta

“

The Oyster platform is super intuitive and easy to use. It’s also very helpful to have everything in one place, like contracts, payroll, and support requests.”

Liz Brisker

Senior People Ops Generalist at Latana

“

With the Oyster platform, it’s easy to review the current status and find the latest documentation, contracts, payroll, and reimbursements.”